2021 Year End Tax And Financial Planning Moves To Consider

By: Randall A. Denha, J.D., LL.M.

With the end of 2021 fast approaching, below are the top year-end financial planning tips Denha & Associates, PLLC planning team is addressing with business owners and executives:

1. Review your estate plan and trust with your financial advisor and attorney.

Because of ongoing developments on federal legislation, your estate plan and trust may need to be modified depending on the current legislation being proposed. For example, an earlier version of the Build Back Better Act included provisions to include grantor trust assets in the grantor’s estate at their date of death value for estate tax purposes. The provisions would have affected most standard Irrevocable Life Insurance Trusts, which are grantor trusts because the trust agreements allow the trustee to use any trust income towards payment of life insurance premiums. I would strongly suggest a review of your current documents to ensure that any flexibility can be met under the current and proposed legislation or whether your documents may need modifications.

2. Consider maxing out tax efficient account contributions.

Contributions to tax efficient savings accounts such as Health Savings Accounts, SIMPLE Plans, IRAs and 401(k)s for retirement savings and 529 Plans for educational expenses are easy methods to maximize tax efficient planning. If you have not reached your contributions thresholds or ownership limits, making additional contributions to such tax efficient savings accounts can provide a simple, tax efficient way to build wealth for the future.

3. Review COVID-19 relief programs.

If you individually or your business received payments through any federal, state, or local COVID-19 relief programs such as the Payroll Protection Program, Employee Retention Credit program, or Shuttered Venue Operators Grant program, the end of the year is a good time to gather your documentation related to each program and save it in your records in case it is needed in the future. Government agencies and banks have been investigating program recipients. If you or your business is currently operating within a relief program, the end of the year is also a natural time to obtain a status update and confirm that you comply with the program’s requirements.

In addition, some relief programs remain open and it is worth examining whether your business may qualify. For example, Employee Retention Credits for 2020 and the first, second, and third quarters of 2021 are currently available for qualifying businesses through the use of amended returns. Under current law and IRS guidance, Employee Retention Credits for 2020 and the first, second, and third quarters of 2021 would remain available as long as the statute of limitations remains open, which is generally three years from the date of filing.

4. More valuable charitable deductions for 2021.

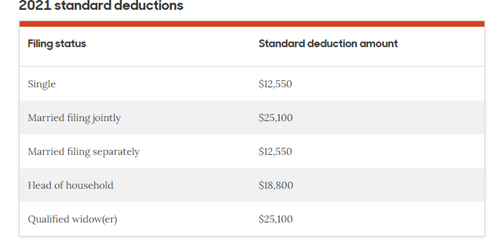

Donations and other gifts to charitable organizations are generally tax deductible. The charitable contribution tax deduction has historically been available only to taxpayers who itemize their deductions, but there is a new $300 deduction that people who don’t itemize can claim in 2021. The 2021 tax rules provide extra tax value for charitable contributions or donations. Individuals using the standard deduction can take a $300 (or $600 if married filing jointly) charitable deduction for cash contributions made to qualifying charities in 2021. For individuals who itemize, generally the charitable contribution deduction is limited to a percentage of adjusted gross income, which typically ranges from 20 percent to 60 percent depending on the type of contribution and charitable organization. Under the new rules, electing individuals can apply an increased limit, up to 100 percent of their adjusted gross income, for cash contributions to qualifying charitable organizations made during 2021. For individuals who plan to make charitable donations each year, depending on the size of the donations it can be more tax effective to save the annual donations (or forgo future donations) and bunch the donations into one tax year.

5. Defer Deductions, Delay Capital Losses To 2022 and Capital Gains

There are a lot of reasons to defer expenses to 2022. If your adjusted gross income is higher next year so you end up losing a deduction, you need to take that into account. So, instead of accelerating deductions, you may wish to defer deductions this year. The same bunching strategy may apply, but instead of bunching this year, you could make charitable donations in a future, higher tax year. Similarly, delaying deductible expenses, as appropriate, may have a bigger impact on reducing income in future years. Should you have appreciated assets that exceed losses, you may wish to harvest capital gains as opposed to capital losses. If you’re anticipating higher long-term capital gains rates in the future, you may want to realize gains in a lower tax environment rather than delay the sale into a higher tax year. A potential increase in capital gains tax has been much discussed and proposed. If you’ve sold appreciated assets throughout the year, you will want to seek losses that can offset the taxable gain. Known as tax-loss harvesting, realizing capital losses can eliminate or reduce the impact of capital gains. It’s important to note that wash sale rules prevent the repurchase of a “substantially identical” security within the 30-day period before or after a security is sold.

6. Get ready for tax season.

You can get a jump on difficult issues now and reap some tax planning benefits by preparing information regarding your business’s 2021 results and 2022 projections. If you had any major changes to your business or important transactions such as the sale or purchase of a business or real estate, your advisors should be made aware so that a reporting and tax strategy can be developed. For example, if your business received a Payroll Protection Program loan, have you discussed with your accountant how to properly report such loan on your company’s books? If employees are working remotely in or your business is selling into new states, have you reviewed potential nexus, sales and use, and employment law and tax issues with your advisors? Likewise, any future plans for the business can be discussed now to develop strategies for limiting liability and tax costs going forward. Now is the time to discuss such issues with advisors before they are crunched for time because of filing deadlines.

7. Succession planning.

Some business owners are thinking of retiring or at least slowing down. For owners looking to sell down the road, restructuring the business, cleaning up the corporate formalities and accounting books, and/or conducting due diligence now can generate value and save costs when the owner does finally decide to sell the business. We can help develop ownership and estate plans to pass the business on to the next generation of family members or managers or sell to third parties.

8. Employee retention.

In the time of the Great Resignation, employers need ways to set themselves apart and retain key employees. Consider your workforce. Are they engaged? What do they value about your workplace? Does dissatisfaction exist and, if so, why? Taking time to evaluate and repair or enhance this portion of your business can reap benefits in the new year. We can help develop employee ownership plans to incentivize employees to remain with the business and to give it their all.

9. Get More Life Insurance Coverage To Cover Estate Tax Increases

A change to the rules on the step-up in cost basis for inherited assets would have a ripple effect for all income levels. While such a change has not been included in recent versions of congressional spending and tax plans, life insurance is a reliable method for passing assets tax-free to beneficiaries and funding a household’s expenses after the death of one or more of its members. For those of you who have not purchased life insurance in the past 10 years, consideration should be given to the loss of the gift and estate tax exemption. Funding an Irrevocable life insurance trust now to purchase a life insurance policy could prove very attractive if the exemption rates are reduced. Mixed-use trusts are more attractive; as the exemption goes down, they have more impact on taxes.