Are Your Deposit And Investment Accounts Protected?

By: Randall A. Denha, J.D., LL.M.

By now you’ve heard about the collapse of Silicon Valley Bank (“SVB”) and the ripple effects it had on its customer base and the concern over the banking system as a whole. While this estate planning attorney wasn’t familiar with SVB, its collapse was the second largest bank failure in the United States! SVB was the go-to lender for startups and many Silicon Valley businesses, including California wineries and farmers. It’s failure has shaken many investors. It was the result of a bank run, caused by the bank’s announcement that it planned to raise $2.25 billion by issuing new common and convertible preferred shares to shore up its finances, after it sold bonds in its portfolio of investments at a $1.8 billion loss.

The FDIC is an independent federal agency that ensures the availability of deposited funds after a bank failure. Created in 1933 after a run on the banks left many account owners penniless, the FDIC promotes public confidence and stability in the nation’s banking system by protecting your insured deposits in an FDIC-insured financial institution. Depositors do not need to apply for FDIC insurance. Coverage is automatic whenever a deposit account is opened at an FDIC-insured bank or financial institution and all FDIC requirements are met.

It’s important to note that the FDIC insured amount is not a per-account limit, but rather a per-depositor limit. This means that if an individual has multiple accounts under their name in the same bank, the total of those accounts will be insured up to $250,000.

Planning tips:

- FDIC-insured institutions include most banks and savings associations located in the United States. It does not include brokerage firms.

- The FDIC covers up to at least $250,000 per depositor.

- FDIC insurance covers the traditional types of bank deposit accounts: checking accounts, savings accounts, money market deposit accounts, certificates of deposit, and certain retirement accounts.

- FDIC insurance does not cover investments in stocks, bonds, mutual funds or money market mutual funds, life insurance policies, or annuities. The FDIC also does not insure US Treasury bills, bonds, or notes, although the US government backs these investments.

Since FDIC doesn’t cover your investments, what can be done? When it comes to protecting your investments, it’s important to understand the different organizations that offer insurance coverage. Two of the most common ones are the Federal Deposit Insurance Corporation (FDIC) and the Securities Investor Protection Corporation (SIPC). In addition, there is also the National Credit Union Administration (NCUA) that offers deposit insurance coverage for credit unions.

FDIC v. SIPC. While both the FDIC and SIPC offer insurance coverage for investments, they differ in their specific areas of coverage. FDIC insures deposits in banks and savings institutions, while SIPC insures securities, such as stocks and bonds, held by brokerage firms.

FDIC insurance covers up to $250,000 per depositor, per insured bank, for each account ownership category, while SIPC insurance covers up to $500,000 per account, but only up to $250,000 for cash claims.

One other notable difference between FDIC and SIPC insurance is how they handle trust accounts. The FDIC insures revocable trust accounts, such as living trusts, for up to $250,000 per beneficiary, per owner.

However, irrevocable trust accounts are insured up to $250,000 for each unique beneficiary, regardless of the number of grantors or trustees. SIPC, on the other hand, insures each separate trust account for up to $500,000, including cash claims.

NCUA VS FDIC. The NCUA is similar to the FDIC, but it only provides insurance coverage for deposits at credit unions. Like the FDIC, it provides coverage of up to $250,000 per depositor, per institution, for each account ownership category. One difference between the two is that the NCUA also provides coverage for unincorporated associations, such as homeowner associations and labor unions. In summary, it’s important to understand the differences between FDIC, SIPC, and NCUA insurance coverage in order to make informed decisions about how to protect your investments.

FDIC Protection and Trusts. A revocable trust account is a deposit account owned by one or more people that identifies one or more beneficiaries who will receive the deposits upon the death of the owner(s). This ownership category includes both informal revocable trusts (such as payable-on-death (POD) accounts) and formal revocable trusts (living trusts established by a written document for estate planning purposes). In general, the owner of a revocable trust account is insured up to $250,000 for each unique beneficiary if all of the following requirements are met:

- The account title indicates that the account is held pursuant to a trust relationship. Terms such as “payable-on-death,” “POD,” “in trust for,” “ITF,” or “trust” may be used.

- The beneficiaries are named in either the account records of the bank (for informal revocable trusts) or identified in the trust instrument (for formal revocable trusts). For formal revocable trusts, language such as “my issue” or other commonly used legal terms to describe beneficiaries can be used, provided that the specific names and number of eligible beneficiaries can be determined.

- To be eligible for coverage, the beneficiary must be either a living person or a charity or nonprofit organization that qualified as such under the Internal Revenue Service regulations.

Insurance coverage for revocable trust accounts is calculated differently depending on the number of beneficiaries named by the owner, the beneficiaries’ interests, and the amount of the deposit. The following rules apply to the combined interests of all beneficiaries the owner has named in all formal and informal revocable trust accounts at the same bank.

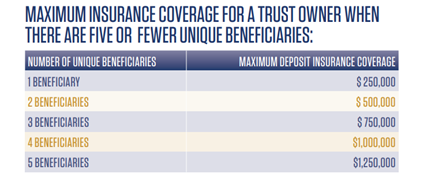

When there are five or fewer beneficiaries, maximum deposit insurance coverage for each trust owner is determined by multiplying $250,000 by the number of unique beneficiaries, regardless of the dollar amount or percentage allotted to each unique beneficiary. Therefore, a revocable trust with one owner and five unique beneficiaries is insured up to $1.25 million.

If you have an account for a joint revocable trust, you and your spouse both have $250,000 FDIC insurance per qualifying beneficiary. In other words, a joint trust with three named beneficiaries will have $1.5 million of FDIC coverage (both spouses have $750,000 of FDIC insurance—$250,000 each for three beneficiaries).

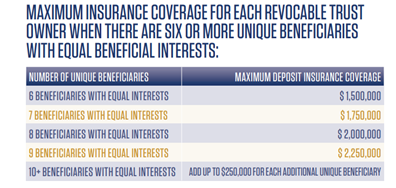

When a revocable trust owner names six or more unique beneficiaries, and all of the beneficiaries have an equal interest in the trust (i.e., every beneficiary receives exactly the same amount), the insurance calculation is the same as for revocable trusts that name five or fewer beneficiaries: The trust owner receives insurance coverage up to $250,000 for each unique beneficiary. An account with one owner and six beneficiaries, with equal beneficial interests, is insured up to $1.5 million.

When a revocable trust owner names six or more beneficiaries and the beneficiaries do not have equal beneficial interests (i.e., they receive different amounts), the owner’s revocable trust deposits are insured for the greater of (1) the sum of each beneficiary’s actual interest in the revocable trust deposits up to $250,000 for each unique beneficiary or (2) a minimum coverage amount of $1.25 million. Determining insurance coverage for a revocable trust that has six or more unique beneficiaries whose interests are unequal can be complex.

Below is a link to the FDIC website outlining a summary of FDIC protection for all account types:

What about Irrevocable Trusts?

When the primary beneficiaries of an irrevocable trust are clearly identifiable and are entitled to receive their distributions without restrictions upon the death of the Trust Grantor (as is almost always the case with a Living Trust), then FDIC insurance for an irrevocable trust account works the same as for a revocable trust account. Each beneficiary’s interest in a Living Trust is almost always a non-contingent interest, meaning there are no conditions in the trust that the beneficiary would need to meet to receive their allocation under the terms of the trust upon the death of the Grantor.

However, certain types of irrevocable trust are written very differently than a Living Trust. If the interest of a beneficiary of an irrevocable trust is “contingent,” all contingent interests are added together and insured up to a maximum of $250,000, regardless of the number of beneficiaries. When the funds in a single irrevocable trust account represent both contingent interests and non-contingent interests, the FDIC will separate the two types of funds before applying the rules described above.

It’s easy to see how multiple trusts complicate these rules. Interestingly, according to the FDIC, it receives more inquiries related to insurance coverage for trusts than all other types of deposits combined. To simplify the rules, the FDIC issued new rules on January 21, 2022, with a delayed effective date of April 1, 2024.

The new rules merge the categories for revocable and irrevocable trusts and use a simpler, more consistent approach to determine coverage. Now, each grantor’s trust deposits will be insured up to the standard maximum amount of $250,000, multiplied by the number of beneficiaries of the trust, not to exceed five. It no longer matters whether the trust is revocable or irrevocable or whether the interests are contingent or fixed. These rules effectively limit coverage for a grantor’s deposits at each institution to $1,250,000 for a single grantor trust and $2,500,000 for a joint trust, assuming that there are five beneficiaries of such trusts. The streamlined rules provide depositors and bankers guidance that’s easy to understand and will facilitate the prompt payment of deposit insurance, when necessary.

To determine your exact FDIC insurance coverage for your trust account(s), you can use the online tool EDIE (Electronic Deposit Insurance Estimator) at:

You can also contact your bank representative or call 1-877-ASK-FDIC (1-877-275-3342) for assistance.

KEY FACTS SUMMARY: FDIC DEPOSIT INSURANCE

- The Federal Deposit Insurance Corp. (FDIC) provides deposit insurance to protect bank deposits in the event of bank failures.

- Deposit insurance applies to various types of deposit products such as single account deposits, joint accounts, revocable trust deposits, and custodial deposits.

- The FDIC insures deposits up to $250,000 per depositor, per bank, for each account ownership category.

- The ownership categories for deposit insurance purposes include single accounts, joint accounts, revocable trust deposits, and certain retirement accounts.

- Excess deposit coverage may be available for deposits exceeding the standard $250,000 insurance limit.

- Safe deposit boxes are not covered by FDIC insurance.

- Deposit insurance rules and limits may vary depending on the type of deposit product and the bank.

- The FDIC provides deposit insurance coverage for bank deposits and does not insure investments such as stocks, bonds, or mutual funds.

- The FDIC also offers deposit insurance products for certain types of deposits, such as brokered deposits and deposits from government entities.

- Depositors can file claims for deposits that are not paid by a bank in the event of bank failures.

- The FDIC has deposit insurance specialists available to answer deposit insurance questions and assist with claims for deposits.

- It is important for depositors to ensure their bank deposit accounts are adequately insured and to keep deposit account records up to date.

- The FDIC Deposit Insurance Form can be used to confirm deposit insurance coverage for bank deposits.

If you are concerned about FDIC coverage for trust accounts, or in general, talk with a qualified Estate Planning attorney. They can help you understand current coverage levels and advise you regarding any moves that you should make now or in the future to receive maximum FDIC insurance coverage.