Estate Planning In A Biden Administration

By: Randall A. Denha, J.D., LL.M.

We can all agree that the estate planning landscape in 2020 was dominated by Covid-19, the U.S. presidential election, the Tax Cuts and Jobs Act (the TCJA), and the Coronavirus Aid, Relief and Economic Security Act (the CARES ACT).

Former President Trump’s administration enacted the TCJA, overhauling the tax code in effect at the time. Generally, the TCJA reduced tax rates for the individuals, corporations, trusts, and estates. President Joe Biden believes the TCJA favors wealthy Americans and wants to change it. In an effort to correct this perceived disparity, President Biden has made the following proposals and has indicated the following intentions (collectively, the “Biden Plan”), aimed at raising taxes at the top levels. Unlike some of his opponents in the Democratic primaries, he didn’t push for a “wealth tax.” But that doesn’t mean he’s opposed to taxing the wealthy more heavily. For instance, to help close the income gap, he wants to raise the highest personal income rate back up to 39.6% (it was lowered to 37% by the 2017 tax reform law), cap itemized deductions for wealthier Americans, limit “like-kind exchanges” by real estate investors, and phase-out the 20% deduction for qualified business income for upper-income taxpayers. He promised not to raise taxes for anyone making less than $400,000, though.

Individual Income Tax

Former President Trump’s administration enacted the TCJA, overhauling the tax code in effect at the time. President Biden now wants to rework the plan that was reworked from the previous administration. He promised to provide tax relief for working families while increasing taxes on those who make more than $400,000 a year. For 2021, he would restore the top tax rate to the level it was in 2017, tax capital gains as income. Under his plan, the top income tax rate for high-income filers would be restored to 39.6%, reversing the TCJA’s decrease to 37%. Long-term capital gains and dividends would be taxed at the 39.6% tax rate on income above $1 million a year. Long-term capital gains (held more than one year) are usually taxed between zero and 20% (as of 2020). The Obamacare tax added an additional 3.8% tax on net investment income for individuals earning more than $200,000 ($250,000 for married couples). Combined with the new highest bracket, that increases the top rate on long-term capital gains to 43.4%. Taxpayers with income under $400,000, however, should not see their individual income taxes raised.

Taxpayers with income of more than $1 million might also face a mark-to-market regime for capital gains and dividends. Here a few other highlights of Biden Plan:

- Tax brackets for high income earners: he proposes to increase the top individual income tax bracket for Americans earning more than $400,000. The tax rate will increase from 37% to 39.6%.

- Capital gains tax: His plan would implement a tax rate of 39.6% on income above $1 million for long-term capital gains and qualified dividends.

- Itemized deductions for high income earners: he proposes to limit itemized deductions, which include state and local taxes, medical expenses, mortgage interest and other deductions, to 28% for high-income taxpayers. Generally, if a high-income taxpayer is subject to a marginal tax rate of 32%, they can reduce their tax liability at the same rate (32%). However, this proposal would mean you could only reduce up to 28%, despite your higher tax rate.

In addition to the above changes, there are a host of other proposed wish list changes ranging from forgiving student loan debt and not subjecting the forgiven debt to tax, expanding the work opportunity tax credit to include military spouses, enhancing access to 401(k), expanding access to ABLE accounts and much more!

Property and Corporate Tax

The Biden Plan proposes eliminating or phasing-out Section 1031 “like-kind” exchanges. It is also possible that Section 1031 would apply only to individuals with taxable income under $400,000. Reform of Section 1031 in any capacity would raise significant revenue and could be seen as protecting small business. Biden’s proposals might also limit the ability of real estate investors with incomes of more than $400,000 to take losses as deductions against taxable income. President Biden proposed to pay for childcare improvements by ending the use of like-kind exchanges and use of real estate losses to reduce tax liability. Addressing 1031 exchanges is among the alternatives to a wealth tax put forward by other Democrats and President Biden seems interested in exploring the same. Don’t assume that income tax changes cannot be retroactive as well. Query-should real estate purchase agreements have a clause that voids the contract if the 1031 rules are restricted? This needs to be strongly considered!

The Biden Plan would also eliminate the bonus depreciation rule for commercial property implemented under the TCJA, which defines internal improvements on commercial property as “qualified improvements,” reduces the depreciation life of qualified improvements to 15 years (from 30 years) and allows qualified improvements to have first year bonus depreciation of 100%. Biden’s proposal would revert the depreciation lives to 25 years for residential property and 39 years for commercial property.

The Biden Plan would increase the corporate tax rate from 21% to 28% and also supports a repeal of the temporary net operating loss (NOL) provisions of the CARES Act, enacted in response to Covid-19, which allows NOLs incurred in 2018, 2019, and 2020 to be carried back for up to five years, while concurrently suspending the 80% taxable limit otherwise imposed for utilizing such NOLs.

In addition, President Biden proposes increasing the global intangible low tax income (GILTI) rate on foreign income from 10.5% to 21% and imposing a 10% tax penalty on corporations that create jobs overseas and sell products back to America in order to avoid U.S. income taxes.

Estate, Gift, and Generation-Skipping Transfer Tax

The U.S. imposes an estate tax of approximately 40% on the net estate of U.S. tax residents. The current exemption from estate tax is $11,700,000 per person, leaving very few estates actually subject to the tax. Under current law, the exemption will revert to $5,000,000, adjusted for inflation, on January 1, 2026. However, President Biden has proposed reducing the exemption to $3,500,000. After democratic wins in Georgia this change could be made as soon as this year. This could be coupled with an increased top rate of 45%. Additionally, although he does not support a “wealth tax,” the Biden Plan might repeal stepped-up basis at death and, moreover, may cause unrealized capital gains to be taxed at death using the proposed increased capital gains tax rates.

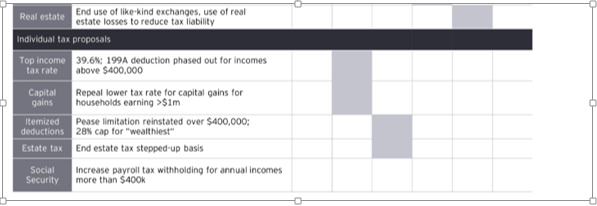

Below is a summary chart of a few of the proposals being considered.

Likelihood Of Enactment and Procedure

With the Democrats capturing Georgia’s two seats in the US Senate in run-off elections, they will now control both chambers of Congress, including their tax-writing committees. While this should give President Biden an easier path to pass much of his tax agenda, there are certain additional Congressional procedures that need to be considered before that happens.

In the Senate, subject to limited exceptions, it typically takes 60 votes to avoid a filibuster (which otherwise could delay or block legislative action). Although Democrats “control” the Senate, they hold only 50 seats. Barring filibuster repeal (which would be an unexpected change to the long-standing Senate rules), the support of at least some Republican Senators will be needed to achieve the 60 votes required to avoid a filibuster and allow tax reform legislation to proceed.

President Biden is able to take advantage of “Budget Reconciliation,” which is a streamlined process for approving bills impacting revenue or spending (including tax measures) and requires only a simple majority for passage. It’s a special process that makes passing budget legislation easier in the Senate. It requires a simple majority of only 51 votes to pass a bill, unlike regular legislation which requires a 60-vote majority. With the recent Georgia Senate wins, the Senate is now split 50-50 between Democrats and Republicans, and Harris will serve as the tie breaker—thus making it easier to pass tax legislation through this process.

Budget reconciliation cannot be used for all types of legislation. In President Biden’s favor, however, the budget reconciliation process has been used since the late 1990s to enact revenue reducing legislation (i.e., tax decreases) and historically has been employed to achieve revenue increasing legislation (i.e., tax increases).

Retroactive Tax Legislation in 2021

Tax legislation could potentially be made retroactive to January 1, 2021. Typically, tax legislation is prospective and might not be effective until Jan. 1, 2022, or later (depending upon how long the enactment process takes). Is this fair? Yes. For a retroactive change in the law to be respected, it must be rationally related to a legitimate legislative purpose. Raising revenue during a historic, not seen in recent history pandemic with historic bailout packages would seem easily sufficient to meet this requirement. Pension Benefit Guaranty Corporation v. R. A. Gray & Co., 467 U. S. 717 (1984); United States v. Carlton, 512 U.S. 26 (1994). Therefore, careful planning should be done to make sure that if this happens there is not an inadvertent gift tax. This can be done with formula clauses, disclaimer provisions, and QTIP elections in a trust for a spouse. Ideally, legislation will be enacted prospectively but it’s best to be prepared.

Planning Uncertainty In 2021

For those clients who failed to gift away assets in 2020, many others are still contemplating additional planning in 2021 to use more or all of their remaining estate, gift and GST tax exemptions before a potential reduction in those exemption amounts (currently $11.7 million under each tax regime), one reason to proceed with some amount of caution is the possibility, as stated above, is that the law is retroactive to January 1, 2021. In other words, a retroactive reduction in exemption amounts to, for example $5 million, could cause otherwise gift-tax free transfers retroactively to be subject to a large amount of gift tax. There is some precedent in previous court cases that suggests such a retroactive law lowering exemption amounts would be legal and constitutional, but it has not been litigated and its outcome would be uncertain. Still, much case law points to the fact that a retroactive change would be appropriate except in a situation where the taxpayer had no reason to think that the tax treatment would later change. Given the amount this topic has been discussed, such an argument that the taxpayer could not have foreseen the change may not be persuasive.

Accordingly, while the law appears to suggest that a change to the estate and gift tax regime may be applied retroactively to January 1, 2021 (if such legislative act is enacted within a reasonable time, such as calendar year 2021), there are, on the other hand, legitimate arguments that suggest a retroactive decrease in exemption amounts unfairly would prevent taxpayers from the opportunity to plan their affairs and, in effect penalize those who try so such retroactive treatment could be disallowed. Regardless of whether such a retroactive change in exemption amounts would be constitutional, it also is important to consider whether Congress would even attempt to make a new law retroactive. More likely, any change in law that is passed in 2021 would be effective on a forthcoming date, such as January 1, 2022. That said, due to the uncertainty of what laws might change and when they would take effect, I highly recommend all individuals contemplating additional 2021 estate and gift planning to contact experienced estate planning professional to navigate the various issues, and to act sooner rather than later to get a planning strategy in place.

If reductions to the gift, estate and GST exemption amounts are made retroactive to January 1, 2021, is there anything that can be done for individuals who made gifts in 2021 prior to the enactment of these changes in law? As I have discussed in prior posts, clients should focus on certain estate planning techniques that can be unwound in order to avoid an unintended gift or GST tax. For example, the individual could consider disclaimer planning, including allowing one beneficiary of a trust to disclaim on behalf of all trust beneficiaries. This should provide the designated beneficiary with nine (9) additional months to disclaim the gift and, if the designated beneficiary does so, the result should be that the gifted assets are returned to the donor without using any of the donor’s gift and/or GST exemption.

Individuals could also consider planning with qualified terminable interest property (QTIP) elections. A married person could make a gift to a trust for the benefit of a US citizen spouse that would qualify for the marital deduction if a QTIP election is made or, if no election is made, would instead pass to a non-qualifying trust for the spouse that would use up the donor spouse’s lifetime exemption. This provides the donor spouse with flexibility either to make the QTIP election or not in the following calendar year when the related gift tax return is due, depending on whether any reduction of the gift and/or GST exemption amount is made retroactive to January 1, 2021.

Finally, an individual could consider making gifts utilizing a formula transfer clause. The donor would make a gift of a fractional interest of an asset where the numerator is the donor’s available exemption on the date of the gift and the denominator is the fair market value of the gifted assets, as finally determined for federal gift tax purposes. If the exemption amount on the date of the gift is retroactively reduced, the formula should “self-correct” so that the donor only gives away an amount equal to the donor’s available exemption on that date..