Selling The Business And Planning Ideas To Consider

By: Randall A. Denha, J.D., LL.M.

According to the U.S. Small Business Administration and Project Equality, 60 percent of business owners plan to cash out of the business in the next 10 years. For the baby boomer generation, it’s especially important as they contemplate retirement, with this generation reportedly owning 2.3 million businesses. When it comes to getting a business ready for sale, there are many components to review and get organized before looking for prospective buyers.

The first thing owners looking to sell their business are being asked is why they’re selling. This may occur for many reasons – voluntary or not. Some people are looking to retire, while others might be looking to exit their business because things soured with partners. These are just some of the reasons why business owners or partners want to sell their business or stake in a company. Entrepreneur magazine says there are “three ways to leave a business – sell it, merge it or close it.”

Selling your business may be the most important financial event in your life. Common questions include: What is my business really worth? How do I get the highest sale price possible? What is the right deal structure? Naturally, these key questions are addressed almost immediately by your corporate deal team. There are, however, additional trust and estate planning strategies that are often overlooked but can deliver as much value as a dramatic increase in sale price.

Interest rates are on the rise but so are valuations in certain industries. Sellers should not only look to maximize value on the sale but, more importantly, look to pre-plan the liquidity event to leave more to their family post-sale. This latter goal is accomplished through appropriate planning with your estate and business planning team.

Three tax-saving strategies to consider

If the sale of your business will be successful enough to leave you with more money than you wish to spend during your life, then there are really only three places this extra money can go: to your family or other loved ones, to charity or to the government in the form of taxes. Pick two.

Unfortunately, taxes can be a significant impediment to realizing the full value of your business upon its sale. A careful analysis of the multitude of taxes that may apply in selling your business is crucial to maximize the proceeds that you’ll receive in the deal. Not only will you want to minimize income taxes on the immediate sale of the business, but you should also consider the taxes that may apply when the money you’ve earned in selling the business passes to the next generation of your family (or your desired beneficiaries).

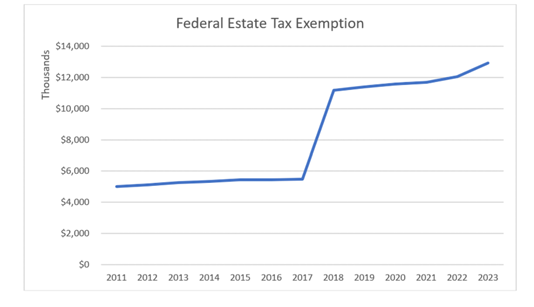

Sharing wealth with loved ones often means benefiting the government by paying gift and estate taxes (collectively called “transfer taxes”), which are assessed on transfers made during life or at death that exceed a certain total amount which is now pegged at $12.92 million per person or $25.84 million for a married couple. The increased exemption is $860,000 more than the 2022 amount and is the result of the rising high interest rates reflected in the rapid growth of the consumer price index. 2023’s larger exemption presents the opportunity for married couples who coordinate their estate planning to protect $25.84 million from estate taxes. Additionally, the exemption amount is unified with the federal gift tax exemption – utilization of this exemption through life-time gifting reduces the amount of exemption available at death. The highest estate or gift tax rate remains the same at 40% next year.

While an analysis of your wealth planning needs is highly personal, there are several common estate planning strategies that work well for many business owners.

Following are three of the most popular strategies that business owners can use to transfer wealth to their families in connection with the sale of their business. These techniques can help business owners save transfer taxes even if the sale of the business does not happen for many years. In fact, many of these strategies work best when they are implemented long before the business is sold.

Straight Gift of Business Interests

A simple yet effective strategy to pass part of the value of the business to your children is to gift an interest in the business to your children (or a trust for their benefit). A non-controlling interest in a privately held business is an ideal asset to give to children because the value of the business interest for gift tax purposes can be discounted by two important features – lack of marketability and lack of control. The key is to engage with your estate planning team early (before signing any letter of intent!) and engaging valuation professionals.

How It Works:

There are few available markets to sell an interest in a privately held company; compared to publicly traded securities, an interest in a private business is highly illiquid. This lack of marketability reduces the value of the business interest for gift tax purposes since the children do not have a marketplace in which to quickly sell the interest for full value. The children also usually receive non-voting shares, or simply do not receive enough of an interest in the business to control voting decisions. Lack of voting control also reduces the value of the business interest for gift tax purposes since the children cannot vote to change any of the operations of the business. These valuation discounts alone can make a gift of an interest in a privately held business a good estate planning strategy for a business owner.

Key Considerations:

- The key to making a gift of an interest in the business a great estate planning strategy is to make the gift before the business is on the market for sale, ideally at a time when the value of the business is still growing.

- If structured correctly, all of the growth on the value of the shares following the date you make the gift will pass to your children free of gift tax.

- A gift of stock can be made to the child, a trust for the child structured in a number of different ways or a combination of the foregoing.

Sale to an Intentionally Defective Grantor Trust (IDGT)

A gift of an interest in a privately held business is a simple yet effective way to transfer assets to your children at a reduced tax cost. This simple technique can be made even more effective by selling the shares to a trust for the benefit of your children, rather than giving the shares to them outright. Don’t let the “defective” name fool you. It’s defective for income tax purposes but “effective” for estate tax purposes. You will pay income taxes for the trust (reducing the value of your estate without it being counted as a gift) while removing the value of the appreciation on your gift from your estate for estate tax purposes (hence the “effective” characterization.)

How It Works:

The trust would buy the shares from you, not for cash, but in exchange for a promise to pay you the value of those shares after a certain number of years. The promissory note would pay interest only (at an IRS-determined interest rate) and a balloon payment at the end of a fixed term. The IRS-determined interest rates are currently at historical lows, which will require less money to flow back to your estate in the form of interest payments and will allow more value to stay in the trust for the benefit of your children. To increase the likelihood that the trust will be viewed as having the ability to repay the promissory note, it is recommended that the trust have cash or other liquid assets of at least 10% to 20% of the face amount of the promissory note. This may require you to make an initial “seed gift” to the trust.

The trust would be designed to be an IDGT, or simply “grantor trust.” This means that you will be treated as the owner of the trust assets for federal income tax purposes during your lifetime, even though the trust assets will not be included in your estate at your death. Although having to pay the trust’s income taxes may seem unattractive, consider that the amount of federal income tax you pay on the trust’s behalf is equivalent to an additional tax-free gift to the trust of the amount of income tax paid. This feature of the trust allows the value of the trust to keep growing for the benefit of your children, without being depleted by federal income taxes. If the business is sold, the trust also does not need to be depleted by paying any of the federal capital gains tax liability on the sale of the business. Another beneficial feature of a “grantor trust” is that the initial sale of the shares to the trust does not trigger capital gains tax because, for federal income tax purposes, the sale is treated as if you had sold the shares to yourself.

Key Considerations:

- If you die before the note has been paid, the IRS might assert that the property sold is included in your estate, or that capital gain on the sale is taxable to your estate when the balloon payment on the note is paid.

- Legal, appraisal and administrative costs of implementing this technique may be significant.

The Grantor Retained Annuity Trust (GRAT)

A GRAT is another highly effective strategy for passing wealth to children or other loved ones in conjunction with the sale of a business. A GRAT is a trust to which you would transfer shares in the business. A GRAT is a trust mechanism by which the grantor transfers wealth and future appreciation in certain property to the grantor’s chosen beneficiaries (generally the grantor’s children) while receiving tax-free annuity payments over a span of years from the trust. Although gifts are generally subject to gift tax, a “zeroed-out” GRAT, otherwise known as a Walton GRAT (think Walmart’s Sam Walton whose family popularized the technique), is a GRAT in which the value of the gift to the beneficiaries is reduced to zero. Put more simply, a Walton GRAT allows a grantor to transfer appreciation of value to beneficiaries tax free.

Another benefit of the GRAT is that the grantor is not required to completely surrender ownership and control of the property transferred to the trust. In fact, by the end of the trust term, the grantor may receive a majority of the assets previously transferred to the GRAT back from the trust. Any assets remaining in the GRAT at the expiration of the GRAT term will be transferred tax-free to the beneficiaries of the GRAT.

How It Works:

The trust will then pay you an annual amount (i.e., an annuity) for a specified term of years. At the end of that term of years, your annuity payments will end, and you will no longer have any interest in the trust property. Any property remaining in the trust will be distributed to your children or other beneficiaries.

For gift and estate tax purposes, you are treated as having made a gift at the time the trust is created. The value of the gift is not the full value of the business interest contributed to the trust. The value of the gift is the present value of the interest passing to your children at the end of the trust term. After all, you have kept the right to receive an annuity for a set term of years, and you are permitted to subtract out the value of the annuity interest when determining the value of the gift.

The value of the annuity interest is calculated using the IRS-published interest rate applicable at the time the GRAT is created. Under current law, it is possible to set the annuity payments high enough such that their calculated value is equal to the value of the business interest contributed to the trust. This is referred to as a “zeroed-out” GRAT because the value of the gift is deemed to be zero in such a case.

As long as the business interest transferred to the GRAT appreciates at a higher rate than the IRS-published rate, there will be property remaining in the GRAT for the benefit of your children when your annuity interest ends. The IRS-published interest rate for GRATs was previously near historical lows, but now has increased to 4.6%, but it may still make sense to strongly consider this technique as part of the planning and transition of the business.

Like all the techniques discussed in this article, it is important to transfer the shares to the GRAT before the sale of the business is imminent. If the sale of the business is nearly complete, it will be difficult to argue that a value lower than the price received in the sale of the business is appropriate for gift tax purposes.

Unlike the techniques discussed previously, a GRAT is generally more effective when a sale of the business is a few years away, rather than many years prior. Unless the shares in the GRAT are generating substantial cash (perhaps through dividend distributions), the annuity payments will have to be made in-kind by transferring shares of the business back to you. Taking the stock out of the GRAT and distributing it back to you reduces the effectiveness of the technique, since the stock is the asset that will appreciate rapidly and will provide the most benefit to your children. Moreover, an in-kind distribution must be supported by an updated appraisal, which adds to the cost and complexity of the GRAT.

Key Considerations:

- If you do not survive the term of the GRAT, a portion (or all) of the GRAT will be included in your gross estate for federal estate tax purposes.

- A GRAT is not an appropriate device to make gifts to grandchildren, great-grandchildren or more remote descendants. For purposes of the generation-skipping transfer tax (a tax levied on certain transfers to grandchildren and more remote descendants), the gift to the GRAT occurs when your annuity interest in the GRAT terminates. At that time, exemption from the generation-skipping transfer tax can be allocated to the trust, but the amount of exemption used would be based on the then fair market value of the trust. If the property in the trust has appreciated as expected, then a large portion of your exemption from the generation-skipping transfer tax would be consumed.

- From time to time, Congress has considered legislation that would greatly hinder the effectiveness of GRATs. In the last several years, Congress has considered prohibiting “zeroed-out” GRATs and requiring GRATs to have a minimum term of 10 years, which would greatly hamper their effectiveness. No such legislation has become law, but some believe that the benefits of GRATs may not be around forever.

- Legal, appraisal and administrative costs of implementing this technique may be significant.

Preparing and planning for the sale of a business can be an overwhelming and emotional time for a business owner. For this reason, it may be tempting to postpone thinking about how your deal will affect your family and other loved ones. If you delay, a golden opportunity to pass part of the value of your business to your family in the most tax-effective manner possible may be gone. Timely action is critical, and engaging your trusted team of advisors to assist you with valuable wealth and estate planning well prior to the sale of your business can help maximize the funds you and your family will receive in the deal.