The Corporate Transparency Act Has Arrived

By: Randall A. Denha, J.D., LL.M.

Happy New Year! It is now January 1, 2024, and the Corporate Transparency Act (CTA) is in effect. The duty to report to the federal government is now here and failure to do so will be met with real penalties and possibly even jail time.

Under the CTA, many business entities formed or registered in the US will be required to provide the personal information of its beneficial owners to the Financial Crimes Enforcement Network (FinCEN), a division of the US Treasury Department. The purpose of the CTA is to combat money laundering, terrorist financing, and other financial crimes by creating and maintaining a central database of the beneficial owners of legal entities.

The principal purpose of the CTA is to strip U.S. shell companies of anonymity that can hide illicit financial activity and for use in financing terrorist activities. But the reach will be overly broad and will impact millions of legitimate small businesses. The world’s developed nations have worked for over a decade to create a system of disclosure to combat bad actors through the Financial Action Task Force (“FATF”). The CTA requires “reporting companies” to report their “beneficial owners” (Beneficial Ownership Information or “BOI”) to a division of the Treasury Department, the (“FinCEN”).

The CTA’s reach will be broad and sweeping. It will impact tens of millions of companies such as most LLCs, corporations, single LLCs owning real estate, LLC holding companies, an estate plan with an LLC owning assets, asset protection plans and so many more entities. It does not matter whether the entity makes money. That is irrelevant. If it owns any asset, then you must report (unless an exception exists.) The CTA is aimed at the small business entity and will capture most of them for reporting.

There are significant civil and criminal penalties for failing to comply, so all entities, entity owners, managers and those controlling these entities, need to be aware of these developments. To make matters worse, the reporting requirement is not a one-time event. There is an initial reporting requirement and then ongoing reporting requirements if there is a change, e.g., a control person moves to a new home address, or a new manager is named for an LLC and that might have to be reported as a change in control persons. These rules will impact many who have implemented estate planning or asset protection planning.

“Reporting Entities” Subject to the CTA

The CTA will apply to entities, including corporations, limited liability companies and limited partnerships, which are formed or registered to do business in the United States by filing with a state-level office (“Reporting Entities”). Estate planning trusts are not Reporting Entities.

NOTE: The entities created in, or registered to do business in, the United States will be required to report to FinCEN information about their beneficial owners. These are the individuals who ultimately own or control a company. The Company has the duty to report. The actual owners are not the ones required to file anything. The burden falls on the companies to keep track of all of the required information for anyone who constitutes a beneficial owner.

The CTA contains twenty-three exemptions, including an important exemption for “large operating companies” having (i) more than twenty full-time U.S.-based employees, (ii) a physical presence in the US, and (iii) more than $5 million in US-sourced receipts or sales. Other exemptions are included for certain subsidiaries, charitable organizations, and companies such as banks and insurance companies that are regulated by other federal agencies.

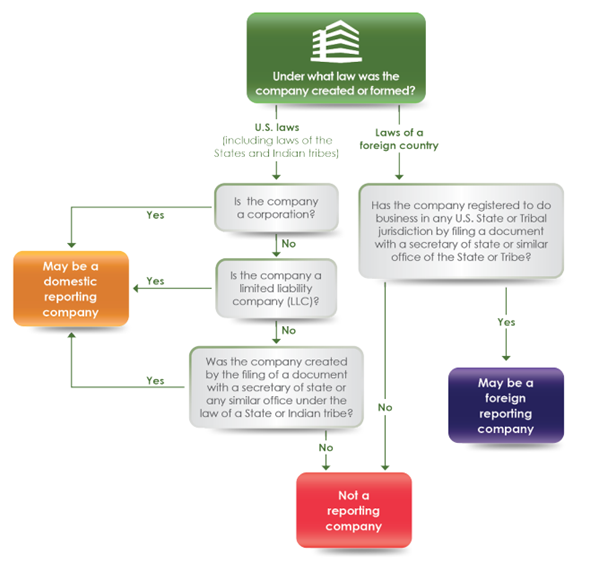

Other than trusts, most entities created for estate planning purposes will not be exempt from reporting, even if an entity is not engaged in a trade or business. For example, an individually or trust-owned LLC that owns as its sole asset a personal residence or an investment portfolio, will be a Reporting Entity required to file. It is immaterial whether it makes money or not. If it owns an asset, then reporting is required. The following chart helps in identifying whether you have a Reporting Company:

What is the Effective Date for filing?

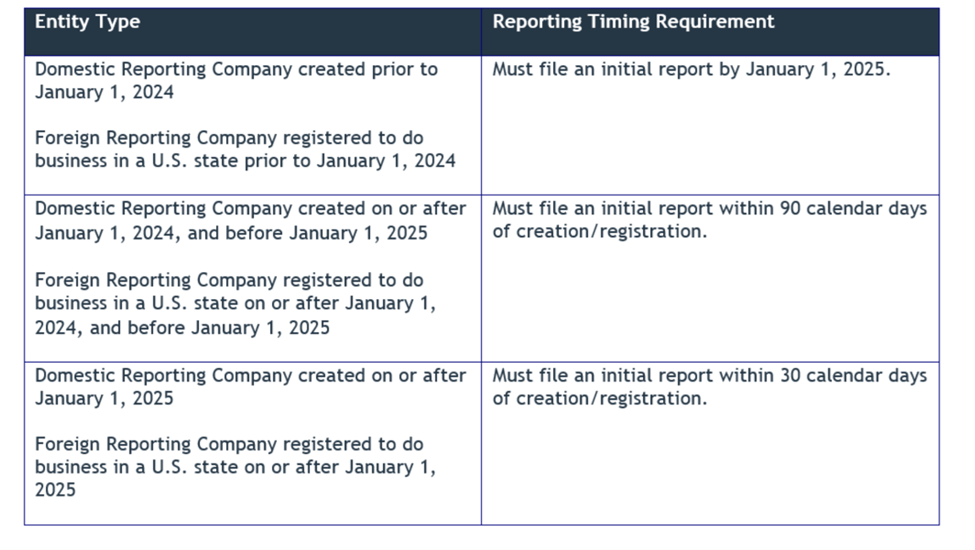

The following chart provides the timing for a filing based on the year of a company formation:

What reporting is required and by who and when?

Reporting companies will be required starting in 2024 to deliver to FinCEN a report containing the following information about the reporting company:

- Entity’s full legal name

- Trade names

- A complete current address

- The jurisdiction it was formed in or jurisdiction in which a foreign company first registers.

- Internal Revenue Service Taxpayer Identification Number and Employer Identification Number

More notably, reporting companies must also furnish the following information to FinCEN about each beneficial owner and company applicant of the reporting company:

- Full legal name

- Date of birth

- Current business or residential address

- A unique identifying number from an acceptable identification document (i.e., passport, driver’s license, etc.) or FinCEN identifier

The CTA defines “beneficial owner” as an individual, who directly or indirectly, exercises substantial control over the reporting company or owns or controls at least 25 percent of the ownership interests of the reporting company. An individual exercises “substantial control” over an entity if the individual 1) serves as a senior officer, 2) has authority over the appointment or removal of a senior officer or a majority of the board of directors, or 3) directs, determines, or has substantial influence over important business decisions.

The CTA also excludes certain individuals and entities from the term “beneficial owner,” including minor children, individuals acting as agents, employees, individuals with a future inherited interest, and creditors. However, the parents of minor children – who would meet the beneficial owner standard but for the exception noted – must have their information reported, according to the CTA.

A “company applicant” is an individual who directly files the formation documents for the reporting company.

Much of the information to be reported is invasive and some may be uncomfortable sharing it with certain advisors. There is an alternative approach that may lessen the information a reporting entity must disclose. A beneficial owner may obtain a special identification number, called a FinCEN identifier, and that number alone may be disclosed instead of disclosing all the information otherwise required. This is a unique identifying number that FinCEN will issue to an individual or reporting company upon request after the individual or reporting company provides certain information to FinCEN.

Once a beneficial owner or company applicant has obtained a FinCEN identifier, reporting companies may report it in place of the otherwise required pieces of personal information about the individual.

You must file updated and/or corrected reports within 30 days of any change. This includes companies that become exempt after filing BOI. If you are currently exempt, you do not need to file BOI claiming an exemption. However, you should consider preserving records relevant to your exemption determination.

Additionally, if you become aware that a report is inaccurate or have reason to know about the inaccuracy, you must correct the report within 30 days.

Who Has Substantial Control of a Company?

The CTA provides four categories for determining if someone has substantial control over a Reporting Company: (1) the individual is a senior officer (i.e., President, CFO, GC, CEO, COO, or any other person, regardless of title, exercising authority of a similar function and not ministerial functions alone); (2) the individual has authority to appoint or remove certain officers or a majority of directors of the Reporting Company; (3) the individual is an important decision-maker; or (4) the individual has any other form of substantial control over the Reporting Company. It is important to note that whether a particular member of the board of directors meets any of these criteria is a question that the Reporting Company must consider on a director-by-director basis. Any individual who directs, determines, or has substantial influence over important decisions made by the Reporting Company, includes decisions regarding the Reporting Company’s:

- Business, such as:

• Nature, scope, and attributes of the business;

• The selection or termination of business lines or ventures, or geographic focus; and

• The entry into or termination, or the fulfillment or non-fulfillment, of significant contracts. - Finance, such as:

• Sales, lease, mortgage, or other transfer of any principal assets;

• Major expenditures or investments, issuances of any equity, incurrence of any significant debt, or approval of the operating budget; and

• Compensation schemes and incentive programs for senior officers. - Structure, such as:

• Reorganization, dissolution, or merger; and

• Amendments of any substantial governance documents of the Reporting Company, including the articles of incorporation or similar formation documents, bylaws, and significant policies or procedures

What are Examples of Ownership Interests?

Ownership is tricky and not an easy task to determine. It is broadly defined to include any type of equity interests. Ownership is not as simple or obvious as it may sound. If the individual owns, directly or indirectly, at least 25% of an entity that will be a reporting company, that person’s interest must be reported. But ownership is broader. “Ownership” is not limited to obvious ownership (e.g., the person owns membership interests in an LLC). This could include a profits interests, convertible instruments, warrants, options, puts, calls, and other entity interests. For example, an instrument that is labelled as debt may be viewed as equity under this rule if it is or may be converted to such in certain events. Ownership interests can be owned or controlled through joint ownership, through a trust arrangement, or other indirect arrangements and may be subject to these rules. Determining who has an ownership interest may require the review of not only governing documents for an entity but ancillary documents and agreements as well.

What Information Must Be Reported About the Beneficial Owner?

All Beneficial Owners must report their: (i) full name; (ii) date of birth; (iii) current residential address; (iv) an identifying ID number along with; (v) a photo of the ID. The ID can be either: a valid U.S. driver’s license, a valid U.S. passport, a non-expired identification document issued by a U.S. state or local government, or Indian Tribe. If an individual does not have any of these documents, a foreign passport must be provided.

What Owners Are Exempt from Being a Beneficial Owner?

The narrow exemptions from the definition of a Beneficial Owner are: (i) minor children (provided the Reporting Company reports the information of a parent or legal guardian); (ii) a nominee, intermediary, custodian, or agent; (iii) an employee (acting solely as an employee whose substantial control over, or economic benefits from, the Reporting Company are derived solely from his or her employment status) and who is not a senior officer; (iv) future interest through a right of inheritance; and (v) a creditor with no other incidents of control. Special rules for limited reporting also apply in certain cases, such as Beneficial Owners whose interests are held through entities exempt from the CTA and foreign-pooled investment vehicles.

In addition to the initial reporting requirements, Reporting Entities must also report changes to beneficial ownership information and changes to information on individuals who exercise substantial control within 30 days of any change.

“Changes” include a change in the party or parties holding beneficial ownership, a previously exempt minor reaching the age of maturity, and a change to reported information (for example, a change in address). Note that if a person dies, that is also a “change”; however, the change is deemed to have occurred on the date the estate was settled, rather than the date of death. Changes in the information provided to FinCEN must be updated. An expired passport is not enough to warrant an update, but a change in the address on the passport, whether expired or not, warrants an update. If companies submit an inaccurate report, they have a 90-day safe harbor to correct said report.

FinCEN does not require companies to file a report after their termination or dissolution. It also does not require companies to report changes to the BOI of their company applicant(s). However, it does require the company to file an updated report stating that it is no longer a reporting company.

A Reporting Company also must file a corrected report in the event that information submitted to FinCEN was inaccurate when filed and remains inaccurate. Corrected reports must be submitted within thirty calendar days of the date on which the Reporting Company became aware of the inaccuracy or had reason to be aware of the inaccuracy.

What are the consequences of reporting violations?

Civil and criminal penalties do not apply to negligent violations, but an individual who willfully fails to report or supplies false information may be subject to civil and criminal penalties, including fines of up to $10,000 and up to two years in prison. As a result, it will be important for reporting companies to capture valid and accurate information from its beneficial owners and company applicants in order to satisfy their reporting obligations under the CTA. As with anything and given the potential penalties and sensitivity of the information provided, beneficial owners should be careful of “official-looking” mail and solicitations to assist them with their BOI reports as bad actors may be attempting to steal owners’ identities.

What should I do now?

If you believe you may qualify as a Reporting Company, practice good corporate housekeeping by:

- Identifying all business entities that are wholly or partially owned or controlled by the Reporting Company

- Determining which entities may qualify for an exemption.

- If no exemption applies, determining Beneficial Ownership for each entity and determining if any entities will need separate tax identification numbers

- Identifying the company applicant(s)

- Dissolving any unneeded, non-exempt entities by the end of 2023

- Establishing record keeping and CTA compliance processes

If any of you wish to read the Act, I have provided the link below to help cure any insomnia:

https://www.fincen.gov/sites/default/files/shared/Corporate_Transparency_Act.pdf