What Are Delegated Trusts And Directed Trusts?

By: Randall A. Denha, J.D., LL.M.

Before going into specific types of trusts, it is important to understand two commonly used trust administration methods and their fiduciary risks. Below we examine delegated trusts, also known as discretionary trusts, and directed trusts.

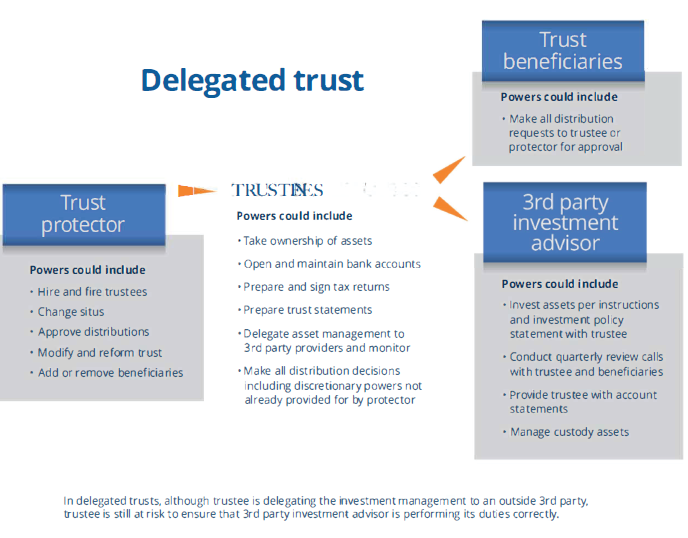

Delegated Trusts

A Delegated Trust names a trustee who delegates investment management to one or more investment advisors according to a trust document or external agreement. The trustee is then responsible for monitoring performance of each appointed investment advisor. At any time, the trustee can remove investment advisors and appoint someone else if they fail to perform.

The trustee likewise controls distribution decisions and typical administrative functions. As an added layer of protection, a delegated trust may also appoint a protector – a super fiduciary, who can hire and fire trustee at will. Some protectors have other powers, for instance, making decisions side by side with trustees regarding distributions and investments.

It is worth noting administrative fees for delegated trusts tend to be higher than directed trusts due to higher fiduciary risk associated with oversight of investment portfolio and distribution decisions.

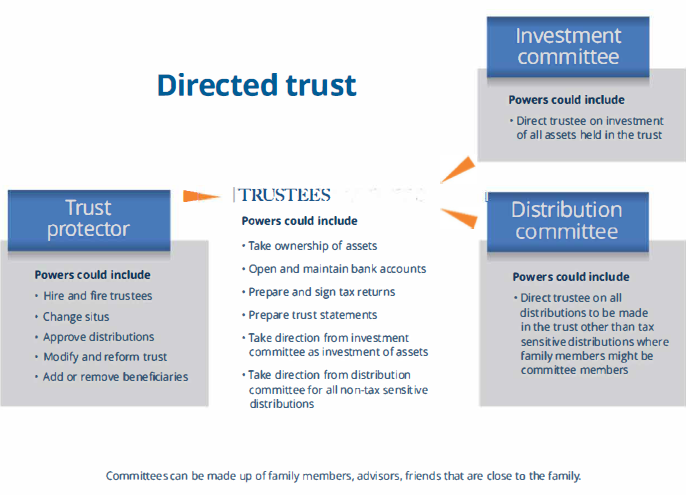

Directed Trusts

A Directed Trust, the Directed Trustee is directed by other participants in the Trust, such as financial advisors and a distribution committee, on matters relating to how the Trust is executed. The Directed Trustee does not have the power to decide how the assets in the Trust are managed, they cannot advise or invest for the Beneficiary. They are in charge of handling certain tasks relating to the management of the Trust and its income, following the terms of the Trust and the direction of those chosen to advise them about the Trust.

In recent years, some states have implemented the Uniform Directed Trust Act to recognize the increased use of Directed Trusts. But to use a Directed Trust, you don’t have to live in one of the states that have enacted legislation relating to these types of Trusts. To use a Directed Trust, however, your Estate should meet certain criteria that make a Directed Trust the most appropriate choice of Trust.

Setting up a Directed Trust may be called for when you want to:

- Manage assets that generate income/profit

- Distribute investments to one or more

- Transfer, buy, sell, or manage real estate

- Split revenue from an asset among several beneficiaries

Who might need a Directed Trust?

A Directed Trust is not needed in every Estate Planning case. A Directed Trust is used primarily for investment accounts when the asset or assets in a Trust are likely to generate regular income and some degree of administrative management is required.

If a Trustor has stock that will generate dividends, an annuity, income property, or another asset that generates income, a Directed Trust may be the right option. If assets and their revenue are to be divided regularly among several beneficiaries, having a middleman of sorts – a Directed Trustee – to handle the distribution of that revenue and see that the initial investment is protected per the Trustor’s wishes and managed per the Trustee’s instructions, can be helpful. And if the asset or assets call for investment expertise, setting up a Directed Trust — where financial advice can be involved and the Directed Trustee will need to listen to investment advisors — may be the right choice.

The directed trust offers greater versatility and control for families while limiting risk to trustees. Here, the trustee is directed as to all distribution and investment decisions, relieving the trustee of fiduciary risk inherent in a delegated trust.

Typically, four parties are involved in this fiduciary arrangement. Along with trust administrators, three stakeholder groups may include family, friends or advisors, as chosen by the grantor (person putting money into the trust). These groups perform various functions:

- Trust protector – makes important decisions regarding the trust, i.e., hiring and firing trustees, changing situs, adding or eliminating beneficiaries, approving distributions and modifying or revising the trust.

- Distribution advisor/committee – instructs trustees on all distributions to beneficiaries, excluding those that are tax-sensitive, and presents a letter of direction to the trustees outlining how distributions are to take place. This power can rest on one person or a committee.

- Investment advisor/committee – appoints relevant parties responsible for managing the investment of trust assets. The advisor or committee along with the appointed investment manager then directs the administrative trustee on matters of investment and generally acts according to an investment policy statement.

- Trust administrator – appointed by grantor or protector. The trust administrator performs administrative trustee duties, including opening and maintaining bank accounts, taking ownership of assets, preparing tax returns and taking direction from distribution and investment advisors/committees.

Choosing the Best Administration Model Clients generally decide between a delegated or directed trust based on personal preference and family dynamics. Some families prefer a delegated trust. All investment and distribution decisions are controlled by the trustee, who is independent and removes family dynamics and bias from administration. For others, greater direct control over assets leads to the directed trust, moving risk to the investment advisor and distribution advisor. Any trust can be managed on a delegated or directed basis, including both revocable and irrevocable trusts.