Year End Planning That Is Different Than Other Years

By: Randall A. Denha, J.D., LL.M.

The one thing we can all agree on is that calendar year 2020 has been a year like no other. We have had wild ups and downs in the stock market. A global pandemic. Race for a vaccine. Virtual learning and much more. All of this has an impact on our mental state, personal finances and mindset.

Believe it or not, we are now in the final stretch of 2020. There are many things still to do and plan for before the end of the year. When reviewing your year-end estate planning or business transition concerns, there are several things to contemplate and review, such as year-end gift giving, valuations, and tax considerations, including issues specific to those who took out Paycheck Protection Program (“PPP”) loans.

Below is a list of items we’ve identified that you might want to consider as you plan for the end of the year and future transitions.

Year-End Gift Giving

Now is also the time to take advantage of lower valuations due to the current environment, such as COVID-19 and other changes in the business landscape. Areas to consider are:

- Marketable securities

- Business interests: includes outright gifting and using family and other entities to remove future appreciation from taxable estates

- Charitable gifts: see below for the CARES Act additional charitable allowances

- Appreciated long-term capital assets

To the extent you make gifts using an exemption in 2020 in excess of the amount of the exemption that might be available to you in a future year, you have made use of a “bonus” exemption that may never be available to you again. For example, if an individual makes a gift in 2020 so that her cumulative gifts are $11 million, no gift tax will be owed in 2020. If the exemption is reduced to $5 million in 2021 and she dies in a year when the exemption remains at $5 million, by making the gift in 2020 she will have used $6 million of “bonus” exemption that is not otherwise available at her death. Assuming the estate tax rate remains at 40 percent, her 2020 gift would result in savings of $2,400,000. In addition to the bonus exemption, any appreciation on the gifted assets after the date of the gift will pass free of estate tax. An additional benefit might be achieved if you gift minority interests in closely held businesses or investment entities. In that case, a valuation often can be obtained for the minority interest which values the gifted assets at a substantial discount.

Estate Planning

There are several considerations for year-end estate planning, including estate and gift tax planning rollbacks and whether your current estate plan needs a tune-up.

- The federal estate, gift, and generation-skipping transfer tax exemptions are all at the historically high level of $11,580,000 per person ($23,160,000 for a married couple). Under current law, the exemptions are scheduled to revert to $5 million per person (indexed for inflation) on January 1, 2026. However, the exemptions could be reduced as early as January 1, 2021, depending upon the results of the upcoming election. These are use-it-or-lose-it types of exemptions and have year-end implications. As stated above, taxpayers might lose this increased exemption if they do not make lifetime gifts by December 31, 2020. This loss might result in increased federal and state estate taxes upon the taxpayer’s death. We encourage you to confer with your estate planning attorneys and other professional advisors to discuss whether a lifetime gift makes sense for your family. It is important to engage in these discussions sooner rather than later—you shouldn’t wait!

- Is your estate plan up-to-date?

- Have you shared essential documents with the people you’ve asked to help with your estate?

- Are your trusts funded?

- Are your beneficiary designations up-to-date?

- Do you want to do any charitable giving before year-end?

- Do you want to do any annual exclusion giving before year-end? You can give up to $15,000 to as many people as you’d like.

Year-End Charitable Giving

Charitable planning is a little different this year. You can still do Qualified Charitable Contributions (QCDs) from IRAs if you are over age 70 ½, up to $100,000, but you may want to give cash to charities this year as you can deduct up to 100% of Adjusted Gross Income or you still may want to give to your Donor Advised Fund where you can give appreciated securities and get a deduction up to 30% of AGI. If cash flow is limited this year because of pandemic issues, you may want to use the money already in the DAF to make gifts or use your IRA to make QCDs.

The 2020 Coronavirus Aid, Relief, and Economic Security Act (“CARES Act”) encourages additional charitable giving in 2020. It allows a $300 above-the-line deduction for cash charitable gifts for non-itemizing taxpayers, and increases the charitable deduction adjusted gross income percentage cap from 60% to 100% for itemizing taxpayers.

Year-End Planning For Income Tax Issues

It’s an election year. That could have a big impact on where tax rates go in the future.

- If you think tax rates could go up in the future, should you consider a partial or full Roth IRA conversion?

- Do you have a capital loss carry forward that you can use to reposition assets?

- Did you roll a required minimum distribution (RMD) back into an IRA or retirement account? Remember to coordinate with your accountant on tax paid on the RMD. If you did return your RMD (plus associated taxes) to your IRA, you may have significantly lower AGI this year. And you may get a refund next April.

- If you have stock options that will expire in the next few years, should you accelerate the exercise to this calendar year? Are there state tax issues that make this even more compelling?

- Are there other “tax bracket planning” opportunities to take before year-end?

- Have you calculated your Basis or cost in an investment before sale?

- Do you have any C corporation losses?

- Are you planning on any 1031 Exchanges or Opportunity Zone investments?

Valuations

In general: Many estate and business succession planning tools require a valuation of a business or real property or other assets. The best valuations are done by independent third parties, and these take time. It is critical that you plan ahead as it might already be too late for 2020.

The reasons for a valuation are numerous: succession planning, estate planning, stock and option programs, partnership splits, refinancing, recapitalization, divorce, etc. There is inherent tension on the reasons for the valuation and the use of the valuation. It’s important to retain experienced appraisers and to engage them for their expertise in the asset being valued. Not all valuation appraisers are created equal. Please keep these items in mind when securing and using a valuation. Below is a link to an article I wrote on this topic in November of 2019:

https://denhalaw.com/the-valuation-of-a-closely-held-business-and-its-importance/

Gifting opportunities and valuation issues: When life gives you lemons . . . Well, you know the rest. Make lemon pie and sell at a profit. Some might say that the COVID-19 economy is giving us lemons. The market is volatile. Asset values are low. Interest rates are virtually nonexistent. But for the well informed, there are always opportunities. While COVID-19 may have had a negative impact on some businesses, a potential opportunity to take advantage of depressed valuations to accelerate gifting for owners that plan on transferring ownership to the next generation exists. Various techniques exist to accomplish this but before undertaking any planning, a valuation expert must be engaged to assist in the valuation of the business. These valuations do take time and we are now in the home stretch with many advisors at capacity. Business owners should make sure their advisors are aware of any recent sales of equity in the business and the valuation used in such transactions. Furthermore, if a business has a buy-sell agreement, business owners should make sure that their advisors are aware of any provisions in such agreements that set a valuation, such as built in formulas. It might be difficult for a business to claim a lower valuation than the one implied by the buy-sell agreement.

Succession Planning

Now is the time to reassess your succession plan due to lower valuations and changing circumstance. Aligning business strategy with your transition and estate plan is more important now than ever. The current hot issues are: (a) valuations post-COVID-19 and re-building enterprise value after COVID-19; and (b) timing and strategy considerations for selling businesses post-COVID-19.

Paycheck Protection Program (“PPP”) Loans and Year-End Planning

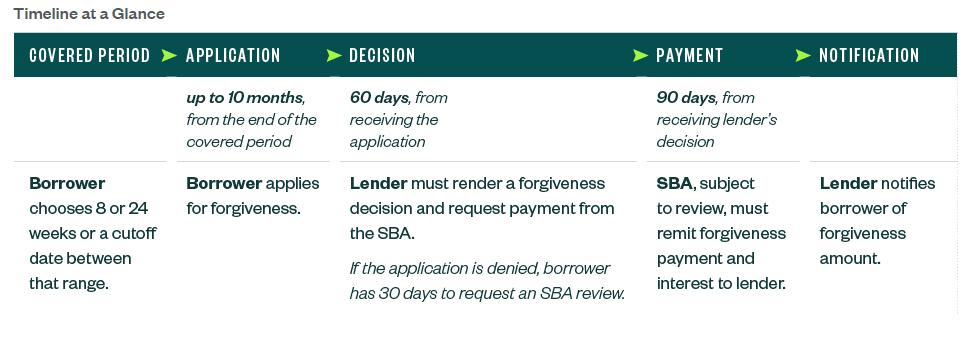

It’s likely you won’t know if your loan is forgiven and by how much until 2021, which will have implications on your tax planning and financial reporting. Here’s what we know about the timeline to apply for forgiveness.

For federal purposes, PPP loan forgiveness may be excluded from gross income by an eligible recipient by the Coronavirus Aid, Relief, and Economic Security (CARES) Act.

However, the IRS issued Notice 2020-32 in April 2020 stated that expenses associated with the tax-free income are nondeductible. This guidance was consistent with historic IRS guidance regarding nontaxable income and related expenses but has the net effect of essentially reversing the tax-free benefit of the exclusion on the loan forgiveness.

While the IRS guidance doesn’t appear to align with Congress’s expressed intention, there hasn’t yet been a law to rectify it despite discussion in Congress about fixing it.

Based on current guidance, we know that expenses associated with forgiveness are nondeductible. What isn’t clear is if they’re nondeductible for 2020 tax returns or not until 2021 when forgiveness is determined.

Not only are there timing issues, but other considerations for year-end planning and tax issues include:

- Accounting for a PPP loan as debt could impact your ability to meet certain covenants because the full amount of the PPP loan would be recognized as debt on the balance sheet and you won’t recognize the benefit of loan forgiveness income until the lender formally forgives the loan and the debt is extinguished.

- Record keeping. It will be important to keep records helping to prove to the SBA the necessity of your loan because the SBA has a five-year statute of limitations to reassess its forgiveness. The SBA has already said it will automatically review PPP loans over $2 million.

- Up-to-date information. There’s a significant calculation that goes into applying for forgiveness. It’s important to keep up on the latest rules and regulation on the program to be sure you’re making decisions based on accurate data.