Creative Estate Tax Strategies To Consider For 2021

By: Randall A. Denha, J.D., LL.M.

It has become a cliché in 2020, but what word other than “unprecedented” can be used to describe the events we’ve experienced this year? During such times, tax planning is far from top of mind. But it’s still important. To take advantage of all available breaks, you need to be aware of some major changes under this year’s Coronavirus Aid, Relief and Economic Security (CARES) Act and last year’s Setting Every Community Up for Retirement Enhancement (SECURE) Act. You also can’t forget about the massive Tax Cuts and Jobs Act (TCJA) that generally went into effect two years ago but still impacts tax planning. Plus, it’s possible that there could be more tax law changes coming very soon!

The new Administration has been quite vocal about a significant reform to a federal estate tax and lifetime gift tax exemption of $3.5 million per person, or $7 million per U.S. citizen married couple. If nothing is done, then the current law reverts the federal estate and lifetime gift tax exemption back to around $5 million per person ($10 million per U.S. citizen married couple) adjusted for inflation as of Jan. 1, 2026. I am doubtful it would get this far as change is almost certain.

The effect of this reform would bring in much needed revenue to support the massive expenses of the pandemic as well as President Biden’s interest in building out the infrastructure. There is “chatter” about doing away with the “step up” of cost basis upon death for capital assets and replacing it with “carry-over basis” (the beneficiary, at death, inherits the decedent’s original cost basis), but this change has never been successful, and it could be inherently problematic.

Take advantage of the current high exemptions and explore gifting strategies now. Time is really “of the essence” and if they wait too long, opportunities will disappear. The following (in no particular order) are some strategies that are fitting for the current environment but may not be so well known.

Satisfaction of a gift by promise

If a grantor satisfies a gift by promise (discussed above) prior to his death, the assets that he uses to satisfy the note will not be included in his gross estate, and his satisfaction of the note will be considered a satisfaction of an obligation as opposed to a gift. If the note is held by an irrevocable trust that is treated as a grantor trust with respect to the grantor for income tax purposes, the grantor could even satisfy the note in-kind by transferring assets to the irrevocable trust without recognition of gain (although a grantor who is engaging in ‘‘deathbed’’ planning may instead prefer for highly appreciated assets to be included in his estate so that the basis of each such asset is stepped up to fair market value upon his death).

Trust with Broad Special Power of Appointment

Another option for a grantor who does not wish to make a gift without a safety net that allows him to access the assets in the future is for the grantor to fund a trust for the benefit of his descendants and/or other persons and organizations the terms of which grant someone (a ‘‘power holder’’) a broad special power of appointment over the assets of the trust. The power holder could exercise his/her special power of appointment in favor of a trust for the donor’s benefit (the ‘‘appointed trust’’), enabling the trust assets to flow back to the donor. For the trust assets to be protected from the creditors of the donor, the trust created by the grantor and the appointed trust should be created under the laws of a state that allows for self-settled trusts to be protected from the claims of creditors (like Michigan, Nevada and several other states.) To minimize the risk of gross estate inclusion under the Tax Code, care should be taken to avoid any ‘‘understanding, express, or implied’’ that the grantor may later benefit from the trust.

Clawback Trusts

A clawback trust is an irrevocable grantor trust currently to be funded with up to what can pass free from the federal exemption. At present, this is an amount equal to $11.7 million, or $23.14 million if married. The terms of the trust will have you as both the grantor and the trustee and can name yourself, your children, and grandchildren as potential beneficiaries. The grantor will have control over the income and an independent trustee will have discretion over principal distributions. Although the trust is irrevocable, the assets inside of it will not be shielded from any claims of creditors. By doing so (under the recent claw back regulations from IRS), they are grandfathering into the larger exemption. In other words, when a client dies, if the law does sunset, the estate will be entitled to an exemption of what it was on the date that the gift was made.

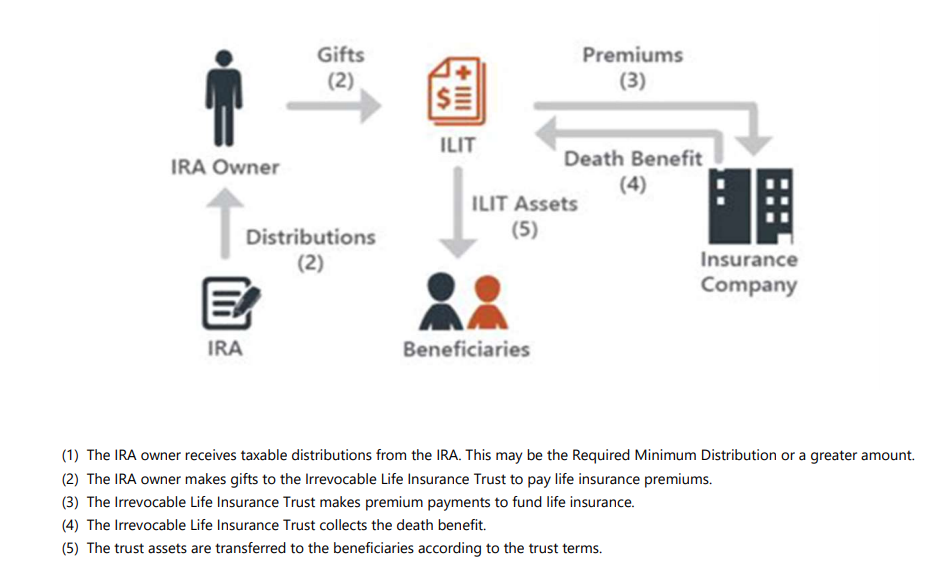

Defunding Retirement Plans To Fund Insurance Plan

Because they offer many income tax advantages, Individual Retirement Accounts (IRAs) can be outstanding wealth accumulation vehicles. However, if you don’t need IRA income for your retirement, transferring this accumulated wealth to your beneficiaries can be quite difficult. The problem is that tax deferred assets, like your IRA or other qualified plans, may be taxed twice at death. IRA distributions are subject to income tax as they are received. In addition, at your death, the account value of your IRA may be subject to estate taxes. The combination of estate and income taxes can erode up to 75% of your IRA’s value. Your beneficiaries may receive only a small fraction of your IRA’s value. Is there a solution to this eventual tax bite? Defunding the IRA and repositioning the assets in the IRA. IRA Repositioning is a strategy whereby a portion of the IRA’s value is systematically placed into an irrevocable trust that purchases a life insurance policy on your life. The after-tax distributions from your IRA are gifted to the trust and used as premium to fund a life insurance policy. If structured properly, the life insurance proceeds would be free of both estate and income tax and provide liquid assets to your beneficiaries. Here is a schematic:

The Setting Every Community Up for Retirement Enhancement (SECURE) Act was passed in December 2019 and became a law as of Jan. 1, 2020. The SECURE Act changed many of the retirement account rules as well as the ability to stretch retirement plan distributions. This change comes in the form of a 10-year distribution rule. This new rule requires most non-spousal beneficiaries of retirement plans after Jan. 1, 2020, to distribute the entire inherited account within 10 years of the account owner’s passing. This 10-year rule applies both to traditional IRAs and to Roth IRAs as well.

Exceptions to the 10-year distribution rule:

- Surviving spouse

- A minor child (10-year rule applies once the minor reaches the age of majority)

- A disabled individual

- A chronically ill individual

- An individual who is not more than 10 years younger than the deceased participant or IRA owner

Prior to this law, beneficiaries could take minimum distributions based on their own life expectancy. For many, this was a tax advantage. With an individual retirement account (IRA), this was commonly referred to as a “stretch IRA” strategy, and the beneficiaries could stretch the amount of time these accounts stayed open, simultaneously reaping the tax benefits in the process.

The new rule could potentially push beneficiaries into a higher tax bracket and will call for both account holders and beneficiaries to reconsider their current estate plans.

Estate Planning – Low Interest Loan to Children

You may have a parent who would like to provide for his or her children, but they do not want to give the kids money right now because they think they might need it at some time in the future. What is an alternative? One alternative is simply to provide a low interest loan to the child. Let’s just look at an example. Right now (May 2021) the minimum interest rate that a parent would have to charge a child for a loan would be 13 basis points for a short-term loan, which is up to three years; 107 basis points for a mid-term loan, which is three to nine years; and 216 basis points for a long-term loan, which is nine years and greater. That is a pretty low interest rate, the lowest we have ever seen. And that can make the loan really attractive. For example, a parent could loan a child one million dollars for five years for the 107-basis point midterm, simple interest rate. The child invests the one million dollars and earns five percent a year on the funds over the next five years, which could happen. At the end of the five years, the million dollars has grown to $1,276,300. The child then owes $53,500 in total interest and the net benefit to the child is $222,800. That worked out well because the parent loaned funds to a child that the child was able to invest successfully. Now, of course, this assumes that the investments produce returns and the interest is paid back. As an aside, you don’t have to worry about family loans being subject to gift tax rules if:

- You lend a child $10,000 or less, and the child does not use the money for investments, such as stocks or bonds.

- You lend a child $100,000 or less, and the child’s net investment income is not more than $1,000 for the year.

Estate Planning – Refinancing a Loan to Family

Another possibility is simply refinancing existing loans where there is a higher interest rate that could be refinanced at a lower rate. This is something many people should look into, be it for commercial loans; but also many times parents, grandparents have loaned children and grandchildren money when there was a higher minimum rate to have a valid loan and that rate is down now and the parent or grandparent may want to consider refinancing the loans at those lower rates. Many clients hold outstanding intra-family loans that were instituted years earlier and then left on “autopilot.” However, an intra-family loan is an obligation like any other and may be refinanced if prevailing interest rates change. And, all else being equal, it is desirable from an estate tax planning perspective to have a lower rather than a higher interest rate on intra-family loans. A promissory note is considered an asset of the gross estate of the lender, meaning that it is potentially subject to federal estate tax.