Joint vs. Separate Trusts for Married Couples

By: Randall A. Denha, J.D., LL.M.

Deciding between joint and separate trusts can be quite confusing. Many factors play into which trust is more suitable. These factors include: how the couple’s assets are titled, the relationship of the couple and the state in which the couple resides.

Both joint and separate trusts have pros and cons. Joint trusts are popular for married couples because they are less expensive to set up, simpler to manage, and reflect the fact that the marital estate is a singular unit. However, individual trusts sometimes offer superior benefits for married couples with respect to asset protection, flexible management, and potential cost savings after the death of a spouse.

Below we’ve compared the strengths and weaknesses of each trust in various scenarios. However, we always recommend to seek legal advice tailored to your specific situation.

ASSET PROTECTION

Separate Trusts

Depending on state law, whether the couple signed a prenuptial agreement and how the couple’s assets are titled, separating the marital estate into two separate trusts may insulate the assets of one spouse from financial risks brought on by the other spouse. Holding assets in individual trusts can make it much more difficult for one spouse’s creditors to get to the assets held in the other spouse’s trust. In addition, since a trust automatically becomes irrevocable when the grantor passes away, it will become even more difficult for creditors (or anyone else) to access the assets in your deceased spouse’s (now) irrevocable trust.

Joint Trusts

Since all marital assets are located in one trust, all assets would be at risk if a creditor obtains judgement over one spouse.

✓ The Winner: Separate trusts may be a better option to protect assets from creditors depending on your state’s laws.

ADMINISTRATION DURING COUPLE’S LIFETIME

Separate Trusts

If the couple’s assets are titled jointly, separating the assets into separate trusts requires some thought and additional steps in funding the trusts. Since each spouse is required to manage their own trust, separate trusts require more work. However, one spouse can name the other as a co-trustee so that both spouses can control all assets in the separate trusts.

Joint Trusts

A joint trust simply means that both spouses are grantors of the trust. In other words, both of you set up this one trust together to administer your assets—first after one of you passes away and then after both of you have died.

If you have been married a long time, most of your assets are jointly owned, and your children are the product of this relationship, you may be a suitable candidate for a joint trust. There are economies of scale with having just one trust—both when it is created and after one spouse dies.

Furthermore, some tax benefits may be available with a joint trust that are not available for individual trusts. Holding property in a joint trust may entitle a married couple to these benefits and preserve them for the surviving spouse.

✓ The Winner: Joint trusts may be easier to manage during a couple’s lifetime.

ADMINISTRATION AFTER A SPOUSE DIES

Separate Trusts

Separate trusts provide more flexibility in the event of a death in the marriage. Since the trust property is already divided, separate trusts preserve the surviving spouse’s ability to amend or revoke assets held within their own trust, while ensuring that the deceased spouse’s trust cannot be amended after death.

Separate trusts also allow spouses to designate how they would like their own assets distributed at death. Each spouse can specify who will inherit and what will be provided to the surviving spouse, while protecting their assets from being inherited from others.

Finally, using individual trusts can allow spouses with children from previous relationships to more easily ensure that when they die, the property they brought into the marriage will only be passed on to their own children and remain in their family. This can prevent valuable assets that have been passed down through your family for generations from leaving your family and winding up in the hands of your spouse’s family. For surviving children, the question would be: does the trust give the surviving spouse the ability to withdraw all of the trust principal and establish a new plan, avoiding the original intent of the trust?

Joint Trusts

Joint trusts do not work well if the spouses have different ideas about how assets will be distributed upon death. At the death of the first spouse, some joint trusts may need to be separated into separate trusts and assets divided. This can create additional expense. Secondly, the administration of an individual trust after a spouse dies is much simpler and more straightforward than that required for a joint trust. The administration of a joint trust after one spouse dies can require a lot of effort to retitle assets, execute new deeds for real property, and establish separate financial accounts to hold the deceased spouse’s separate property. Moreover, there will often be the question, which part of the trust remains subject to the surviving spouse’s amendment, and which part has become truly irrevocable?

✓ The Winner: Separate trusts may be easier to manage following the death of a spouse.

ESTATE TAX BENEFITS

Separate Trusts

Separate trusts provide tax relief for affluent couples with combined estate totaling higher than the federal estate tax exemption (combined $25,840,000 for 2023.)

Joint Trusts

A property drafted joint trust can achieve same estate tax marital deduction planning benefits as separate trusts.

✓ The Winner: This one’s a tie! If properly drafted, both can provide the same estate tax benefits.

SPECIAL CIRCUMSTANCES

Blended Families

- Separate living trusts are useful for blended families (families with children from previous partners) and where each spouse has obtained their assets before getting married.

- In these cases, each spouse usually wants to ensure their own children inherit their assets after they pass away.

- A separate trust can ensure their assets remain unaffected by the other spouse; as using a joint trust can leave uncertainty over whether the surviving spouse will provide for the surviving child.

High-Risk Professions

- If one spouse is involved in a high-risk profession or business, then separate trusts can protect the other spouse from potential legal risk.

- The couple can share the assets between each other’s separate trusts so that in the event of legal issues, the family’s key assets (such as homestead, annuities and retirement accounts) remain protected.

When One Spouse Has a Large Inheritance

- If one spouse expects to inherit a very large inheritance, then a separate trust may also be suitable.

- The inheriting spouse can use the trust to separate this inheritance from their partner, to maintain control of it.

Disproportionate Wealth Situations

- Separate trusts can also be suitable for spouses with very different testamentary plans.

- For example, a wealthy spouse can design a plan that provides for their surviving spouse but also provides for select friends, relatives, and charities.

The surviving spouse would use a separate living trust as they wouldn’t need to leave money for the wealthy spouse, but would rather share it with loved ones more in need.

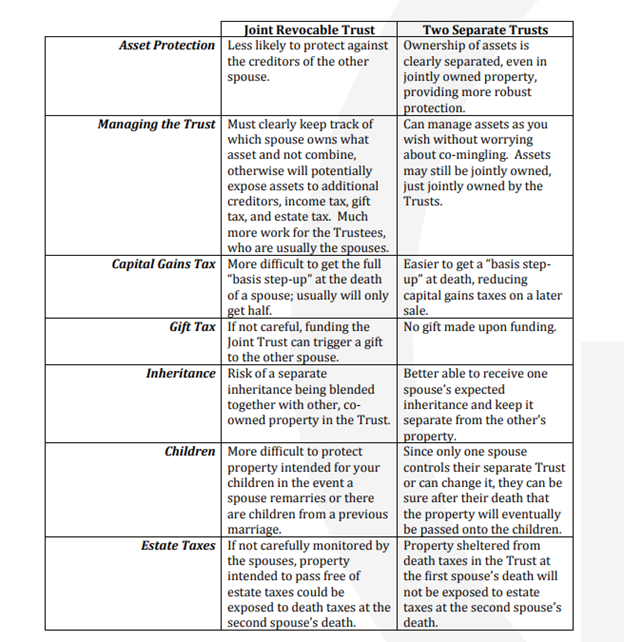

Below is a summary chart for review: