Protecting Your Assets While Estate Planning

By: Randall A. Denha, J.D., LL.M.

Knowing the difference between asset protection and estate planning is the first step when it comes to protecting your property for yourself and future generations.

Asset protection aims to find ways to proactively protect assets. Once you have integrated your financial goals with your estate planning goals and positioned or repositioned your assets to be protected from creditors, you will have a comprehensive asset protection plan in place. Asset protection is about preserving your hard-earned wealth in the face of unreasonable creditors’ claims, frivolous lawsuits or financial predators. It’s not about evading legitimate debts, hiding assets or defrauding creditors.

Estate planning determines how assets are cared for and protected when an individual can no longer manage them or they pass away. Here’s everything you need to know about how estate planning is a vital component of asset protection.

Thankfully, there are many asset protection strategies you can implement. If your business, professional or personal activities expose your assets to attack by unscrupulous litigants or creditors, consider incorporating these strategies into your estate plan.

Asset protection is not just about protecting your assets from creditors or relegated only to the wealthy. Asset protection, in its simplest form, is any method used to protect your hard-earned wealth from loss and dissipation due to life’s many uncertainties. Asset protection is for everyone.

Asset protection strategies help keep assets from being absorbed or taken by others by protecting yourself and loved ones from creditors or financial complications due to divorce. Asset protection plans can help protect homes, business interests, funds and more. It’s a way to give stability in an often-unstable world. With a solid estate plan in place, you and your family will be able to handle the unexpected with ease, decorum, in a timely manner, and according to your wishes.

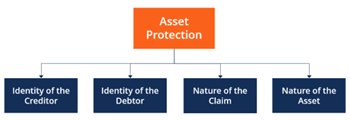

How Does Asset Protection Work? Asset protection planning is based on the analysis of various factors that determine the degree of protection required. The following diagram shows the most important factors:

Identity of the Debtor

If the debtor is an individual, it is important to consider any transmutation agreements (agreements that determine whether properties are equally shared by spouses or separate) between the individual and their spouse. It is also important to consider the likelihood of a lawsuit for each spouse – so that property rights for assets can be transferred to the ‘safer’ individual before lawsuits are filed.

If the debtor is an entity, then the individual who guaranteed the repayment is liable to asset seizure in the event of a lawsuit. For asset protection planning, it is important to take note of any clause that obliges an individual to personally repay an organization’s/entity’s debt and the likelihood of creditors seizing personal assets.

Identity of the Creditor

The identity and type of creditor are important for asset protection planning. If the creditor is a powerful organization, like the government, they are likely to possess more power over asset seizure compared to private lenders. Individuals who are liable to an aggressive creditor may require stronger asset protection strategies and vice versa.

Nature of the Claim

The specific types of claims and limitations included in lending agreements determine the strength and type of asset protection required. For example, dischargeable claims (claims that can be written off or “injuncted” by the court) can be used to protect personal assets in the event of bankruptcy and require a relatively lower degree of asset protection.

Nature of the Asset

Many types of assets are exempt from creditor claims. For example, the homestead exemption protects homeowners from forced home sales for debt repayment. Therefore, it is important to consider the types of assets included in the claims of creditors and the likelihood of each of the assets getting seized in the event of a lawsuit.

What are your options?

When it comes to asset protection, there’s a wide variety of techniques to consider. Here are several, from the simple to the complex:

Buy insurance. Insurance is an important line of defense against potential claims that can threaten your assets. Depending on your circumstances, it may include personal or homeowner’s liability insurance, umbrella policies, errors and omissions insurance, or professional liability/malpractice insurance. The practical reason for making sure that adequate insurance is in place is that if a particular claim is covered by insurance, then the asset protection plan may never be implicated in the first place. Even if a claim exceeds policy limits, in most cases there will still be a settlement within policy limits because of the risk of litigation.

Give it away. If you’re willing to part with ownership, a simple yet highly effective way to protect assets is to give them to your spouse, children or other family members, either outright or through an irrevocable trust. After all, creditors can’t go after assets you don’t own (provided the gift does not run afoul of fraudulent conveyance laws). Choose the recipients carefully, however, to be sure you don’t expose the assets to their creditors’ claims.

Retitle assets. Another effective technique is to retitle property. For example, the law in many states allows married couples to hold a residence or certain other property as “tenants by the entirety,” which protects the property against either spouse’s individual creditors. It doesn’t, however, provide any protection from a couple’s joint creditors.

Contribute to a retirement plan. You may be surprised to learn that maxing out your contributions to 401(k) plans and other qualified retirement plans doesn’t just set aside wealth for retirement, it protects those assets from most creditors’ claims as well. IRAs also offer limited protection: In the event of bankruptcy, they’re protected against creditors’ claims up to a specified amount, based on state law. Outside bankruptcy, the level of creditor protection depends on state law, which varies from state to state.

Establish a DAPT. A domestic asset protection trust (DAPT) can be an attractive vehicle because, although it’s irrevocable, it provides you with creditor protection even if you’re a discretionary beneficiary. DAPTs are permitted in around one-third of the states, but you don’t necessarily have to live in one of those states to take advantage of a DAPT. However, you’ll probably have to locate some or all of the trust assets in a DAPT state and retain a bank or trust company in that state to administer the trust. The amount of protection provided by a DAPT varies from state to state.

Offshore Trust. Now, this is considered the most powerful tool to protect money from lawsuits. The best asset protection trusts are formed offshore. How do they work? Local courts do not have jurisdiction over our foreign law firm that serves as the trustee. It ties the hands of the courts and the opponent’s attorney. The strongest legal statutes are in the Cook Islands and Nevis. In fact, the offshore trust is one of the few asset protection strategies that work after a lawsuit is filed.

It is the responsibility of the Trustee to:

- Follow the terms expressed in the ‘Deed of Trust’ – a very narrow number of duties are normally given.

- Defend the trust against debtors – a key element of any asset protection trust.

- Invest the trust appropriately.

- Act impartially amongst the beneficiaries.

- Be accountable to all beneficiaries, keep them informed and act in their best interest.

- Not delegate duties or profit themselves from transactions.

While it might sound somewhat complicated, a trust is simply a three-way agreement that allows one party (Settlor) to transfer their property to a second party (Trustee) to benefit a third party (Beneficiaries). What’s different about an offshore trust? It is just like a regular trust, except abroad. A typical structure places an offshore LLC inside of the trust. The LLC holds the bank account. That way, you can serve as LLC manager and account signatory until you need the international law firm to step in and protect you. Suppose a judge orders you to turn over the money. An offshore law firm is not under the judge’s jurisdiction. So, the law firm can legally refuse to comply. This strategy works best for liquid assets you hold safely in an internationally institution.